Payment Plans for Online Degrees Flexible Options

Discover flexible payment plans offered by institutions for online degree programs to manage your educational expenses.

Payment Plans for Online Degrees Flexible Options

Discover flexible payment plans offered by institutions for online degree programs to manage your educational expenses.So, you've decided to pursue an online degree. That's fantastic! Online education offers incredible flexibility and access to learning that traditional campuses sometimes can't match. But let's be real, one of the biggest hurdles for many students, whether online or on-campus, is figuring out how to pay for it all. Tuition, fees, books, technology – it adds up. While student loans and scholarships are often the first things that come to mind, there's another super helpful option that many institutions offer: payment plans. These aren't loans; they're essentially agreements with your school to break down your tuition and fees into smaller, more manageable installments over the course of a semester or academic year. Think of it like paying for a subscription service, but for your education!

This article is going to dive deep into the world of payment plans for online degrees. We'll explore what they are, how they work, the different types you might encounter, and why they can be a game-changer for your financial planning. We'll also look at some specific examples of institutions and their payment plan offerings, giving you a clearer picture of what to expect. Our goal here is to empower you with the knowledge to make informed decisions about financing your online education, especially if you're in the US or Southeast Asia, where online learning is really taking off.

Understanding Online Degree Payment Plans What They Are and How They Work

At its core, a payment plan is a simple concept: instead of paying your entire tuition bill upfront at the beginning of the semester, you pay it in several smaller, scheduled payments. This can significantly ease the financial burden, especially if you're working, have family responsibilities, or just don't have a large lump sum readily available. Most institutions offer these plans directly through their financial aid or bursar's office, or sometimes through a third-party service they partner with.

Here's a general breakdown of how they typically work:

- Enrollment: You usually need to enroll in the payment plan before the semester's tuition deadline. There might be a small, non-refundable enrollment fee, which is usually much less than the interest you'd pay on a loan.

- Down Payment: Often, a small down payment (e.g., 10-25% of the total balance) is required at the time of enrollment.

- Installments: The remaining balance is then divided into equal monthly installments. The number of installments can vary, but it's commonly 3 to 5 payments per semester.

- Automatic Payments: Many plans require or strongly encourage automatic payments from a checking or savings account, or even a credit card. This helps ensure you don't miss a payment.

- No Interest: This is a key differentiator from student loans. Most institutional payment plans are interest-free, though late payment fees can apply if you miss a deadline.

The beauty of these plans is their flexibility. They allow you to budget more effectively, aligning your educational expenses with your regular income flow. This is particularly beneficial for online students who might be juggling work and studies, or those who are self-funding their education without relying heavily on traditional loans.

Benefits of Flexible Payment Options for Online Students Financial Management

Why should you consider a payment plan for your online degree? The benefits are numerous, especially for the unique circumstances of online learners:

- Improved Cash Flow: Instead of a massive bill, you have smaller, predictable payments. This makes it easier to manage your monthly budget and avoid financial strain.

- Avoid Debt: Since most payment plans are interest-free, you can avoid taking on additional student loan debt, or at least reduce the amount you need to borrow. This is a huge win for your long-term financial health.

- Accessibility: Payment plans make higher education more accessible to a wider range of students who might not qualify for traditional loans or have the immediate funds for upfront tuition.

- Budgeting Control: Knowing exactly how much you owe each month helps you plan your finances more effectively. You can set aside the necessary funds without surprises.

- No Credit Checks: Unlike private student loans, institutional payment plans typically do not require a credit check, making them available to students regardless of their credit history.

- Reduced Stress: Financial stress can significantly impact academic performance. By breaking down costs, payment plans can alleviate some of that pressure, allowing you to focus more on your studies.

For online students, who often have diverse backgrounds and financial situations, these benefits are amplified. Many online learners are adult learners, balancing careers, families, and other commitments. A flexible payment plan can be the difference between pursuing their educational goals and putting them on hold.

Types of Payment Plans Exploring Different Structures and Terms

While the core concept remains the same, payment plans can vary in their structure and terms from one institution to another. It's crucial to read the fine print and understand what each plan entails. Here are some common variations:

Semester-Based Payment Plans Tuition Installments Per Term

This is the most common type. The total tuition and fees for a single semester are divided into a set number of installments, usually 3 to 5. For example, if your tuition for a semester is $5,000, a 4-month plan might require a $1,250 payment each month after an initial down payment. These plans typically reset each semester, requiring re-enrollment.

Annual Payment Plans Extended Payment Options for Academic Year

Some institutions offer annual payment plans that cover the entire academic year (fall, spring, and sometimes summer). This can be even more convenient as you only enroll once for the year, and your payments are spread out over a longer period, perhaps 8 to 10 months. This can lead to even smaller monthly payments, further easing the financial burden.

Third-Party Payment Plan Providers External Financial Services

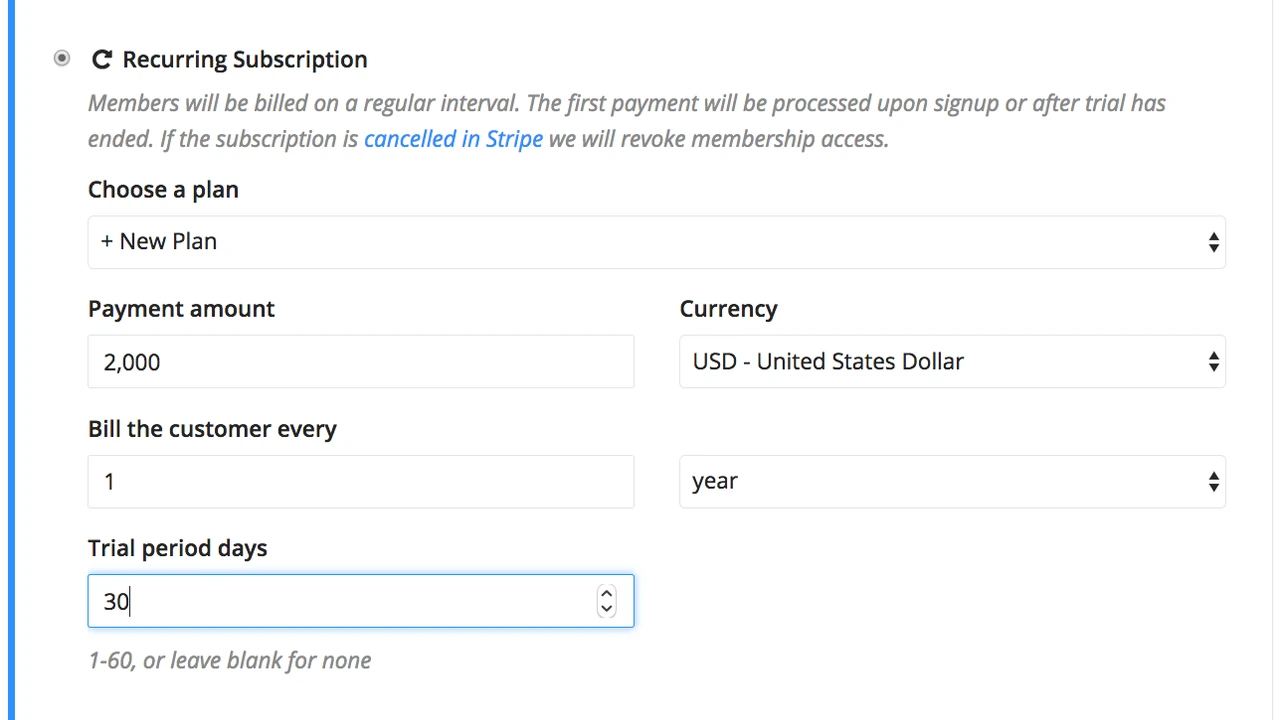

Many universities partner with third-party companies to administer their payment plans. These companies specialize in tuition management and often offer user-friendly online portals for enrollment and payment tracking. Examples include Nelnet Campus Commerce (formerly Tuition Management Systems - TMS) or TouchNet. While the school sets the terms, these providers handle the logistics. It's important to understand that even with a third-party provider, the plan is still interest-free for the tuition portion, though the provider might charge their own enrollment fee.

Customized Payment Arrangements Special Circumstances and Flexibility

In some cases, especially for students facing unique financial hardships, institutions might be willing to work out customized payment arrangements. This is less common and usually requires direct communication with the financial aid office. It's always worth asking if you have extenuating circumstances, but don't expect this to be a standard offering.

When comparing plans, always look at:

- The enrollment fee.

- The required down payment percentage.

- The number of installments.

- The due dates for each installment.

- Any late payment fees or penalties.

- Whether the plan covers all charges (tuition, fees, room/board if applicable, etc.) or just tuition.

Comparing Payment Plans Across Institutions US and Southeast Asia Examples

Let's look at some real-world examples of how payment plans are structured at various institutions, keeping in mind our target markets of the US and Southeast Asia. Please note that specific terms can change, so always verify directly with the institution.

US Institutions Flexible Tuition Management Solutions

University of Florida UF Online

UF Online, a highly-ranked online program, typically offers a deferred payment plan. While not a traditional installment plan, it allows students to defer a portion of their tuition payment until later in the semester, often after financial aid disbursements. For a more structured installment plan, they often direct students to a third-party provider like Nelnet Campus Commerce. For example, for a Fall semester, you might enroll in July or August, make an initial payment, and then have 3-4 subsequent monthly payments. The enrollment fee is usually around $50-$75 per semester. This is great for students who receive financial aid but need to cover the initial gap before funds arrive.

Arizona State University ASU Online

ASU Online, known for its extensive online offerings, provides a tuition installment plan through their Student Business Services. Students can typically enroll for a small fee (e.g., $35-$50) and divide their tuition and fees into 3 or 4 monthly payments per semester. They often require the first payment at the time of enrollment. This is a straightforward, institution-managed plan that's easy to access through their student portal. It's ideal for students who prefer direct dealings with the university.

Southern New Hampshire University SNHU Online

SNHU, a leader in online education, also offers payment plans. They often partner with a third-party provider to manage these. Their plans typically allow students to spread tuition payments over several months within a term, with a modest enrollment fee. SNHU is known for its military-friendly policies, and their payment plans often integrate well with military benefits, allowing for flexible payment schedules around benefit disbursement dates. This is a good option for military personnel or those who need a slightly longer payment window.

Southeast Asian Institutions Emerging Online Education Payment Models

Online education in Southeast Asia is rapidly growing, and with it, more flexible payment options are emerging. While not as universally standardized as in the US, many institutions are adopting similar models.

Universitas Terbuka Indonesia Open University

As a large open university, Universitas Terbuka (UT) in Indonesia offers very affordable tuition. While they might not have traditional monthly installment plans in the same way US universities do, their fee structure is often per credit unit or per course, allowing students to pay as they go. This 'pay-per-module' approach inherently offers flexibility, as students only pay for the courses they enroll in each semester. This is a great model for students who want to manage their costs on a course-by-course basis.

Open University Malaysia OUM Flexible Learning Solutions

OUM is a pioneer in open and distance learning in Malaysia. They offer various payment schemes, including installment plans. Students can typically pay their tuition fees in a few installments within a semester, often with a small administrative fee. They also have options for EPF (Employees Provident Fund) withdrawals for education, which acts as another form of flexible financing. Their plans are designed to accommodate working adults, which is a large demographic for online degrees in the region.

University of the Philippines Open University UPOU Accessible Education

UPOU, the distance learning arm of the prestigious University of the Philippines, offers relatively low tuition fees. While they might not have formal monthly payment plans like US universities, their fee structure often allows for partial payments at the beginning of the semester, with the balance due later. They also work with various scholarship programs and government subsidies that effectively reduce the upfront cost for many students. Their focus is on making education accessible, and their payment policies reflect that.

Key Differences and Similarities

Across both regions, the core idea is to break down large payments. US institutions often use third-party providers and have more formalized monthly plans with enrollment fees. Southeast Asian institutions, while sometimes offering installments, might also rely on lower per-credit costs or government/employer subsidies to provide flexibility. Always check the specific university's financial aid or bursar's website for the most up-to-date information.

How to Enroll in a Payment Plan Step-by-Step Guide

Enrolling in a payment plan is usually a straightforward process. Here's a general guide:

- Check Eligibility: First, confirm that your chosen online degree program and your student status make you eligible for a payment plan. Most students are, but it's good to double-check.

- Access Your Student Account: Log in to your university's student portal or financial aid website. Look for sections related to billing, tuition, or payment options.

- Locate Payment Plan Information: You should find details about available payment plans, including terms, fees, and enrollment deadlines.

- Review Terms and Conditions: Carefully read all the fine print. Understand the enrollment fee, down payment, number of installments, due dates, and any penalties for late payments.

- Enroll Online: Most institutions allow you to enroll in the payment plan directly through their online portal or the third-party provider's website.

- Set Up Payments: You'll typically need to provide bank account information for automatic withdrawals or set up credit card payments. This is often the most convenient and reliable method.

- Confirm Enrollment: Once you've completed the process, you should receive a confirmation email or notification detailing your payment schedule.

- Monitor Your Account: Regularly check your student account and bank statements to ensure payments are being processed correctly.

Pro Tip: Enroll early! Payment plan deadlines often coincide with tuition due dates, and enrolling early ensures you secure your spot and avoid any last-minute rushes or potential late fees.

Potential Pitfalls and How to Avoid Them Smart Financial Planning

While payment plans are fantastic, they're not without their potential downsides if not managed carefully. Here's what to watch out for and how to avoid common pitfalls:

Late Payment Fees Understanding Penalties for Missed Deadlines

This is the biggest one. While payment plans are interest-free, they almost always come with late payment fees if you miss an installment. These fees can range from $25 to $100 or more per missed payment. Missing multiple payments can also lead to holds on your student account, preventing you from registering for future classes or accessing transcripts. Solution: Set up automatic payments and mark all due dates on your calendar. Ensure you have sufficient funds in your account on payment due dates.

Enrollment Fees Initial Costs to Consider

Remember that small, non-refundable enrollment fee? While minor compared to tuition, it's still an added cost. If you drop out of the plan or withdraw from classes, this fee is usually not refunded. Solution: Factor the enrollment fee into your overall budget. Compare it against the cost of taking out a small loan or using a credit card for the upfront tuition, which might incur higher interest.

Impact on Financial Aid Coordination with Scholarships and Loans

Payment plans generally work well alongside financial aid. However, it's crucial to understand how they interact. If your financial aid (grants, scholarships, loans) covers a portion of your tuition, your payment plan installments will be based on the remaining balance. Solution: Always communicate with your financial aid office. Ensure they have the most up-to-date information on your aid package so your payment plan reflects the correct outstanding balance.

Withdrawal Policies Understanding Refunds and Obligations

What happens if you withdraw from your online program after enrolling in a payment plan? This can get tricky. You might still be responsible for a portion of the tuition, and the payment plan might not automatically cancel. Solution: Familiarize yourself with your university's withdrawal and refund policies *before* you enroll in classes or a payment plan. Understand your financial obligations if you need to withdraw.

Budgeting Challenges Overestimating Your Capacity to Pay

It's easy to look at smaller monthly payments and think, 'I can totally afford that!' But life happens. Unexpected expenses can pop up, making those monthly payments difficult. Solution: Create a realistic budget. Don't just look at the payment plan amount; consider all your monthly income and expenses. Build in a small buffer for emergencies. If you anticipate difficulty, contact the financial aid office *before* you miss a payment.

Integrating Payment Plans with Other Funding Sources Holistic Financial Strategy

Payment plans are rarely the sole solution for financing an online degree. They work best as part of a broader financial strategy, complementing other funding sources. Here's how they can fit in:

Scholarships and Grants Maximizing Free Money First

Always prioritize scholarships and grants, as this is 'free money' you don't have to pay back. Once these funds are applied to your tuition, any remaining balance can then be covered by a payment plan. This significantly reduces the amount you need to pay out of pocket or borrow. Many online students are eligible for specific scholarships, so do your research!

Federal and Private Student Loans Strategic Borrowing

If scholarships and grants aren't enough, federal student loans are usually the next best option due to their lower interest rates, flexible repayment options, and potential for deferment. Private loans should be considered a last resort. A payment plan can help you reduce the amount you need to borrow, as you can cover a portion of your tuition directly, thus minimizing your loan burden.

Employer Tuition Assistance Leveraging Workplace Benefits

Many employers offer tuition reimbursement or assistance programs. If your employer covers a portion of your tuition, a payment plan can bridge the gap until you receive reimbursement. You pay the installments, and then your employer repays you. This is a fantastic way to get your degree with minimal out-of-pocket cost.

Personal Savings and Income Self-Funding Your Education

For those who are self-funding, payment plans are invaluable. They allow you to use your current income or savings to pay for your education in manageable chunks, rather than depleting your savings all at once or taking on unnecessary debt. This is particularly relevant for adult learners who might have established careers and savings.

By combining these strategies, you can create a robust financial plan that makes your online degree affordable and manageable. Think of the payment plan as a flexible tool in your financial toolkit, designed to make the journey smoother.

Real-World Scenarios and Success Stories How Payment Plans Help

Let's imagine a few scenarios where payment plans truly shine:

Scenario 1 The Working Parent Balancing Responsibilities

Maria is a single mother working full-time, pursuing an online Bachelor's in Business Administration. Her employer offers $2,000 in tuition reimbursement per year, and she received a $1,000 scholarship. Her semester tuition is $4,500. After her scholarship and employer reimbursement (which she receives at the end of the semester), she still needs to cover $1,500 upfront. Instead of taking out a small, high-interest loan, she enrolls in her university's 4-month payment plan. With a $50 enrollment fee and a $375 down payment, she then pays $375 for the next three months. This fits perfectly into her monthly budget, and she avoids debt.

Scenario 2 The Career Changer Investing in a New Future

David wants to transition into data science and enrolls in an online Master's program. He has some savings but doesn't want to deplete them entirely. His tuition per semester is $7,000. He qualifies for a federal student loan of $3,000. The remaining $4,000 is still a significant sum. He opts for the university's 5-month payment plan. After a $75 enrollment fee and a $800 down payment, he pays $800 for the next four months. This allows him to keep a healthy emergency fund and only take out a minimal loan, which he plans to pay off quickly once he lands his new data science job.

Scenario 3 The International Student Managing Currency Exchange

Lina, from Vietnam, is pursuing an online degree from a US university. The tuition is quoted in USD, and currency exchange rates can fluctuate. Instead of converting a large sum at once, she uses the university's payment plan. This allows her to convert smaller amounts of VND to USD each month, potentially mitigating the impact of unfavorable exchange rate fluctuations and making the payments more manageable from her local income.

These examples highlight how payment plans offer practical, flexible solutions for diverse student populations, making online education a reality for many who might otherwise find it financially challenging.

Future Trends in Online Degree Payment Options Innovation and Accessibility

The landscape of online education is constantly evolving, and so are the ways students pay for it. We can expect to see even more innovative and flexible payment options in the future:

Micro-Credential and Modular Payment Structures Pay-As-You-Learn

As micro-credentials and modular learning become more prevalent, payment structures will likely adapt. Instead of paying for a full degree, students might pay per module, per course, or even per skill learned. This 'pay-as-you-learn' model offers ultimate flexibility and aligns costs directly with the value received at each step.

Income Share Agreements ISAs Alternative Financing Models

Income Share Agreements (ISAs) are gaining traction, particularly in bootcamps and some degree programs. With an ISA, you receive funding for your education and, in return, agree to pay a percentage of your future income for a set period after graduation. While not a traditional payment plan, it's a highly flexible option that defers payment until you're employed and earning. This could become more common for online degrees, especially in high-demand fields.

Blockchain and Cryptocurrency Payments Decentralized Options

While still nascent, the use of blockchain and cryptocurrency for tuition payments could offer new avenues for international students, potentially reducing transaction fees and speeding up cross-border payments. This would add another layer of flexibility, especially for students in regions with complex banking systems.

AI-Powered Financial Advising Personalized Guidance

AI tools could become more sophisticated in helping students navigate financial aid, scholarships, and payment plans, offering personalized recommendations based on their financial situation, academic goals, and even predicted future earnings. This could make the process of finding the best payment strategy much simpler and more efficient.

The future of financing online degrees is bright, with a clear trend towards greater flexibility, personalization, and accessibility. Payment plans, in their current and evolving forms, will continue to be a cornerstone of this financial ecosystem, empowering more individuals to pursue their educational aspirations without undue financial burden.

Ultimately, choosing an online degree is a significant investment in your future. Understanding and utilizing flexible payment plans can make that investment much more manageable and less stressful. Don't let the upfront cost deter you; explore all your options, and you'll likely find a path that works for your budget and your goals. Happy learning!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)