Comparing Private vs Federal Student Loans for Online Degrees

Understand the differences between private and federal student loans for online degrees to choose the best option.

Understand the differences between private and federal student loans for online degrees to choose the best option. Navigating the world of student loans can feel like deciphering a complex code, especially when you're pursuing an online degree. You've got two main players in this game: federal student loans and private student loans. Both can help you fund your education, but they come with vastly different rules, benefits, and potential pitfalls. For students in the US and even those in Southeast Asia looking to study in the US, understanding these distinctions is absolutely crucial for making smart financial decisions.

Federal Student Loans The Government Backed Advantage

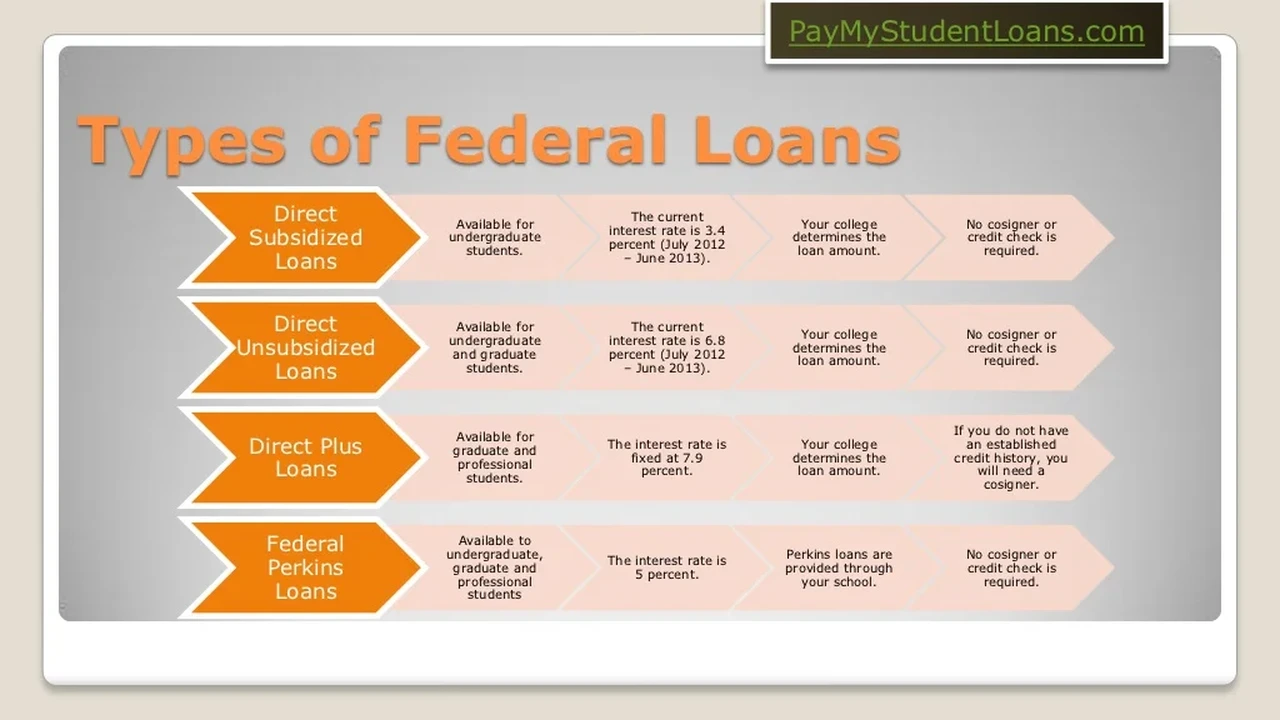

Federal student loans are issued by the U.S. Department of Education. They're often considered the first and best option for most students because they come with a host of benefits and protections that private loans simply don't offer. Think of them as the safety net of student financing.Types of Federal Student Loans for Online Learners

There are a few different flavors of federal loans, each with its own characteristics:- Direct Subsidized Loans: These are for undergraduate students with demonstrated financial need. The big perk here? The government pays the interest on the loan while you're in school at least half-time, during your grace period, and during deferment periods. This can save you a significant amount of money over the life of the loan.

- Direct Unsubsidized Loans: Available to both undergraduate and graduate students, regardless of financial need. The downside is that interest accrues from the moment the loan is disbursed, even while you're in school. You can choose to pay the interest as it accrues or let it capitalize (add to your principal balance), which will increase your total repayment amount.

- Direct PLUS Loans: These are for graduate or professional students (Grad PLUS) and parents of dependent undergraduate students (Parent PLUS). They require a credit check, but the eligibility criteria are less stringent than for private loans. They can cover up to the cost of attendance minus any other financial aid received.

- Direct Consolidation Loans: Not for new borrowing, but these allow you to combine multiple federal student loans into a single loan with one servicer and one monthly payment. This can simplify repayment and sometimes lower your monthly payment by extending the repayment period.

Key Benefits of Federal Student Loans for Online Education

Why are federal loans often the preferred choice for online degree students?- Fixed Interest Rates: Federal loan interest rates are fixed for the life of the loan, meaning they won't change. This provides predictability in your monthly payments.

- Income Driven Repayment IDR Plans: This is a huge one. If your income is low after graduation, IDR plans can adjust your monthly payments based on your income and family size. Some plans can even lead to loan forgiveness after a certain number of years (typically 20 or 25 years) if you meet certain conditions. This is a lifesaver for many graduates, especially those starting out in lower-paying fields.

- Deferment and Forbearance Options: If you face financial hardship, you can temporarily postpone or reduce your loan payments. This flexibility is invaluable during unexpected life events.

- Loan Forgiveness Programs: Beyond IDR forgiveness, federal loans offer programs like Public Service Loan Forgiveness (PSLF) for those working in qualifying public service jobs. While specific conditions apply, these programs can erase your remaining loan balance after a certain period.

- No Credit Check for Most Loans: Direct Subsidized and Unsubsidized Loans don't require a credit check, making them accessible to students with limited or no credit history.

Private Student Loans Understanding the Commercial Landscape

Private student loans are offered by banks, credit unions, and other private lenders. They are not backed by the government and typically have fewer borrower protections. Think of them as a more traditional loan product, similar to a car loan or a mortgage, but specifically for education.When to Consider Private Student Loans for Online Degrees

Private loans usually come into play after you've exhausted all federal aid options, including grants, scholarships, and federal student loans. They can fill the gap if your federal aid doesn't cover the full cost of your online degree.Key Characteristics of Private Student Loans for Online Education

Here's what you need to know about private loans:- Credit-Based Approval: Private lenders almost always require a credit check. If you have a limited credit history (common for younger students), you'll likely need a co-signer with good credit to get approved and secure a favorable interest rate.

- Variable or Fixed Interest Rates: Private loans can come with either fixed or variable interest rates. Variable rates can start lower but can fluctuate over time, potentially increasing your monthly payments. Fixed rates offer stability but might start higher.

- Fewer Repayment Protections: Private lenders generally offer fewer flexible repayment options compared to federal loans. Income-driven repayment plans are rare, and deferment/forbearance options are often limited and at the lender's discretion.

- No Loan Forgiveness Programs: Private loans typically do not qualify for federal loan forgiveness programs like PSLF or IDR forgiveness.

- Interest Accrues Immediately: Like unsubsidized federal loans, interest on private loans usually starts accruing as soon as the loan is disbursed.

Comparing the Two Federal vs Private Student Loans for Online Study

Let's put them side-by-side to highlight the critical differences for online degree students:| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Lender | U.S. Department of Education | Banks, credit unions, private financial institutions |

| Interest Rates | Fixed, generally lower than private loans | Fixed or variable, often higher than federal, depends on credit |

| Credit Check | Not required for most (Subsidized/Unsubsidized); required for PLUS | Always required; co-signer often needed for good rates |

| Financial Need | Required for Subsidized; not for Unsubsidized/PLUS | Not a factor |

| Repayment Plans | Income-Driven Repayment (IDR), Standard, Graduated, Extended | Limited options, typically Standard; some offer temporary hardship options |

| Deferment/Forbearance | Generous options for economic hardship, unemployment, etc. | Limited, at lender's discretion, less flexible |

| Loan Forgiveness | Public Service Loan Forgiveness (PSLF), IDR forgiveness | Generally none |

| Origination Fees | Yes, typically a small percentage | Can have origination fees, but not always |

| Borrowing Limits | Annual and aggregate limits | Can borrow up to the cost of attendance, less other aid |

Recommended Private Loan Products and Scenarios for Online Degrees

While federal loans are usually the first stop, there are situations where private loans become necessary. When you do need to explore private options, it's crucial to shop around and compare offers from multiple lenders. Here are a few reputable private lenders and what they generally offer, keeping in mind that terms and rates can change and depend heavily on your creditworthiness (or your co-signer's).Sallie Mae Smart Option Student Loan

- Overview: Sallie Mae is one of the largest and most well-known private student loan lenders. Their Smart Option Student Loan is popular for its flexibility in repayment options while in school.

- Key Features: Offers three in-school repayment options: deferred repayment (no payments until after graduation), fixed monthly payments (small, fixed payments while in school), or interest-only payments. This flexibility can be a big plus for online students who might be working part-time or have limited income during their studies.

- Use Case: Ideal for online students who need to cover a significant gap after federal aid and prefer some payment flexibility during their degree program. It's also a good option if you have a strong credit history or a co-signer with excellent credit to secure a competitive rate.

- Potential Cost: Interest rates can range from around 4% to 16% (variable) or 5% to 17% (fixed), depending on credit score and chosen repayment option. Origination fees are typically not charged.

Discover Student Loans

- Overview: Discover offers private student loans with a focus on transparency and customer service. They often have competitive rates for borrowers with good credit.

- Key Features: No application fees, no origination fees, and a 0.25% interest rate reduction for setting up automatic payments. They also offer a cash reward for good academic performance (e.g., 1% cash reward on each new loan if you earn a 3.0 GPA or higher).

- Use Case: A strong contender for online students who are confident in their academic performance and want to be rewarded for it. Also suitable for those who prioritize no fees and a straightforward application process.

- Potential Cost: Variable rates typically range from 4% to 15%, and fixed rates from 5% to 16%.

College Ave Student Loans

- Overview: College Ave is known for its highly customizable loan options, allowing borrowers to choose their loan term and in-school payment plan.

- Key Features: Offers a wide range of repayment terms (from 5 to 15 years) and in-school payment options (full deferment, interest-only, or flat $25 payments). This customization can help online students tailor their loan to their specific financial situation and future income projections.

- Use Case: Excellent for online students who want maximum control over their repayment structure. If you have a clear idea of your post-graduation income and want to align your loan term accordingly, College Ave could be a great fit.

- Potential Cost: Variable rates can be as low as 4% and go up to 15%, while fixed rates typically range from 5% to 16%. No origination fees.

CommonBond Student Loans

- Overview: CommonBond focuses on a personalized approach and offers competitive rates, particularly for graduate students. They also have a strong social mission.

- Key Features: Offers both fixed and variable rates, with flexible repayment options. They also have a unique 'Social Promise' where they fund the education of a child in need for every loan they fund.

- Use Case: Particularly attractive for online graduate students who might have a higher earning potential post-degree and appreciate a lender with a social conscience.

- Potential Cost: Variable rates can start around 4% and fixed rates around 5%, going up to 15-16% depending on credit. No origination fees.

SoFi Student Loans

- Overview: SoFi is well-known for its student loan refinancing, but they also offer private student loans. They cater to borrowers with strong credit profiles.

- Key Features: Competitive rates, no fees (no origination fees, no late fees, no insufficient funds fees), and unemployment protection (can pause payments for a period if you lose your job).

- Use Case: Best for online students who have excellent credit or a co-signer with excellent credit and are looking for a lender with no hidden fees and some borrower protections.

- Potential Cost: Variable rates can start around 4% and fixed rates around 5%, going up to 15-16%.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)